AI’s $4 Trillion King: Nvidia’s Unstoppable Rise

Tech titan Nvidia shattered records on July 10, 2025, becoming the first company in history to cross the staggering $4 trillion market capitalization threshold. The chip giant’s stock hit $163.87 in early trading before settling near record highs by the close. Not too shabby for a company that was just another semiconductor player a decade ago. Now they’re eating everyone’s lunch.

Nvidia’s $4 trillion milestone isn’t just breaking records—it’s rewriting the entire playbook for tech dominance.

The meteoric rise represents a 21% jump year-to-date, blowing past the broader semiconductor index like it was standing still. Even more impressive? The stock has surged a whopping 88% from its April 2025 lows. Analysts see more runway ahead, with consensus targets of $174.18 – another 8% climb from current levels. The company’s predictive analytics capabilities have revolutionized how businesses forecast market trends. Talk about momentum.

Nvidia’s dominance stems from one thing: AI. The company’s H200 and B200 chips power virtually every major artificial intelligence platform on the planet. Their exclusive partnership with the US government’s “Stargate” AI supercomputing project didn’t hurt either. And that CUDA software ecosystem? Pure genius. Creates the kind of lock-in most tech companies can only dream about.

Just look at the competition. Broadcom sits at a “mere” $1.298 trillion. TSMC? A paltry $1.2 trillion. AMD and Intel aren’t even in the same galaxy at $226 billion and $101 billion respectively. Only three semiconductor companies have ever hit trillion-dollar valuations. Nvidia just quadrupled that benchmark. Because they can.

Technical analysts are drooling over Nvidia’s charts. A textbook bullish engulfing pattern in April kicked off this rally. Support levels at $130 and $97 provide a solid floor. Some predict the stock could hit $300 by year-end. The “golden cross” formation has the true believers practically giddy.

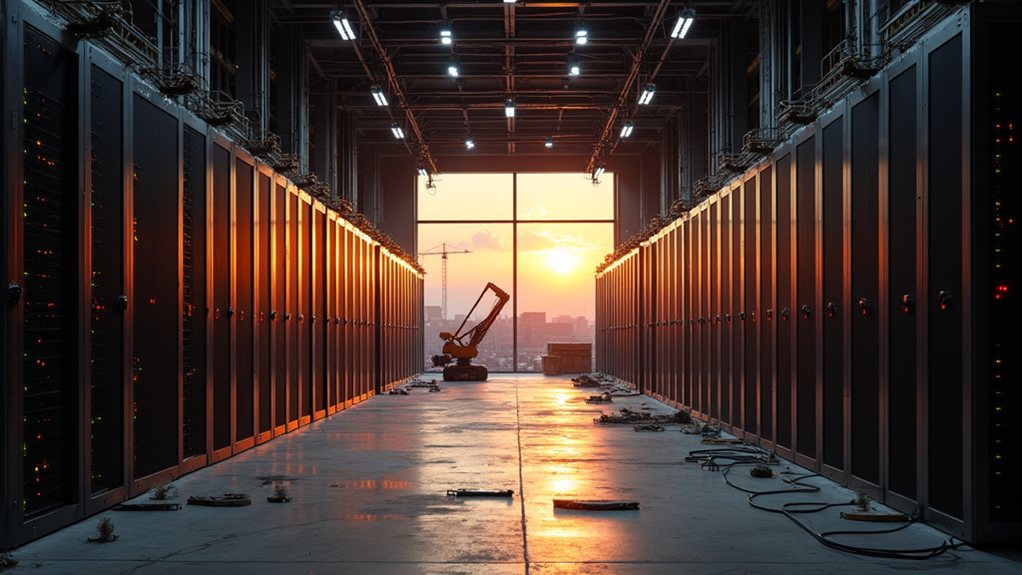

Every major tech player – Microsoft, Amazon, Google, Meta, OpenAI – depends on Nvidia’s hardware. Period. These firms are spending billions building AI data centers stacked with Nvidia GPUs. Despite some cautionary notes from Microsoft Azure about expansion pace, the overall AI infrastructure buildout shows no signs of slowing. Nvidia’s GPUs continue to be the industry standard due to their unmatched performance for AI training and inference applications. Loop Capital’s bold forecast suggests the company could reach a 6 trillion market cap by 2028 if current growth trajectories hold.

Wall Street’s consensus is clear: Nvidia isn’t just riding the AI wave – they built the surfboard everyone else is standing on. Their $4 trillion valuation reflects actual revenue potential, not hype. In the race to dominate AI infrastructure, Nvidia isn’t just winning. They’re lapping the field.